Retail businesses setting budgets and forecasting are understandably finding it difficult to navigate the uncertain economic conditions.

Our research can help educate retailers about industry profitability benchmarks, wage growth and inventory levels, so that businesses can better prepare for the future.

Profitability benchmarks

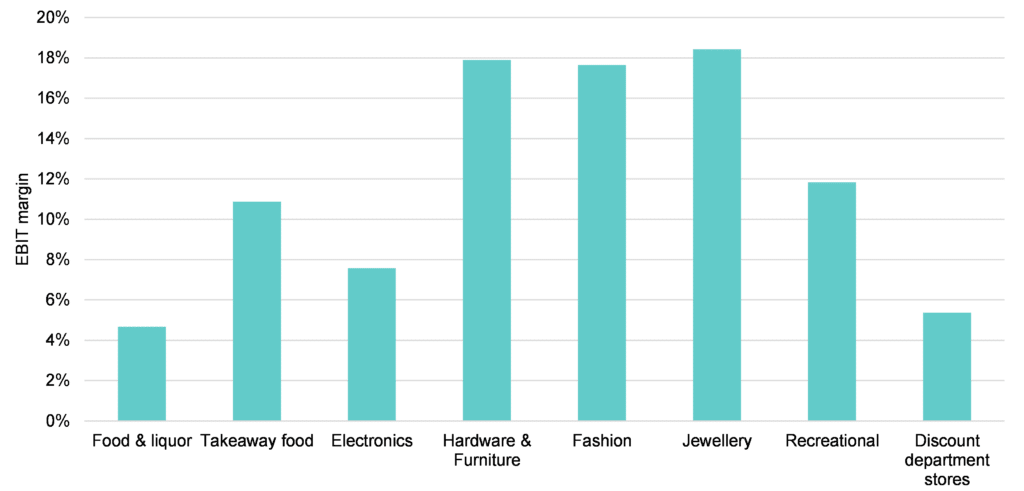

In the chart below, we have benchmarked the EBIT margin for each category for the most recent results to 31 December 2022. Across this universe of companies reflected in the benchmarks, the dominant driver of EBIT margin change over the last three years (1H23 vs pre COVID-19) was gross margin gains, closely followed by elevated sales growth ahead of cost growth.

EBIT margin benchmarks vary significantly by category.

- Food & liquor: Food & liquor recorded the lowest EBIT margin at 4.7%. Supermarket profit margins are now higher than pre COVID-19 levels. The EBIT margin change in 1H23 vs 1H20 was entirely driven by gross margin gains.

- Takeaway food: Takeaway food recorded EBIT margin at 10.9%. Over the last three years, food franchise businesses have lower profit margins, given higher wage cost growth and limited price rises.

- Electronics: Electronics recorded an EBIT margin at 7.6%. Appliances have shown the largest EBIT margin gains in 1H23 compared to 1H20.

- Hardware & furniture: Hardware & furniture recorded a comparatively high EBIT margin at 18% in 1H23. Profit margins are well up for housing and outdoor categories that saw heightened demand during COVID-19.

- Fashion & jewellery: Jewellery has recorded the highest EBIT margin at 18%, with fashion closely behind. Dispersion in profit margin performance is wider for specialty retail groups. Margins have also been impacted by changes in business mix in some cases.

- Recreational goods: Recreational goods recorded an EBIT margin at 12%. This category recorded one of the largest EBIT margin gains in 1H23 compared to 1H20.

- Discount department stores: Discount department stores recorded the second lowest EBIT margin at 5.4%. While this category recorded quite significant dispersion in profit margin performance, the category recorded one of the largest EBIT margin improvements in 1H23 compared to 1H20.

Chart: EBIT margin by category in 1H23

Source: Company reports, MST Marquee

Outlook

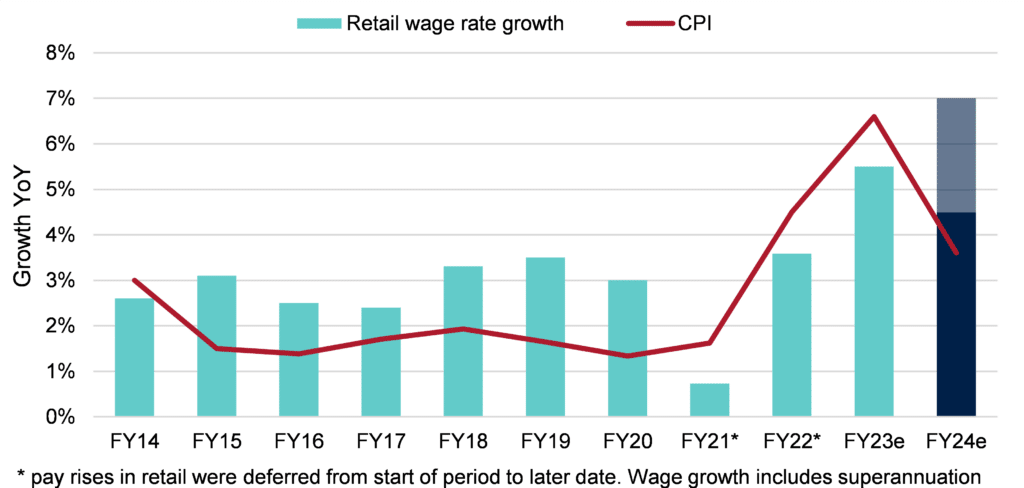

Wage growth likely to be high again in FY24e

The Fair Work Commission (FWC) will hand down its minimum wage decision in late May or early June 2023. A wage rate determination of anywhere from 4.5%-7.0% is plausible in our view with a rate at the upper end possible given the real wage decline workers have had over FY22 and FY23.

At 4%, retailers are likely to manage decent margin outcomes given some variability in staff costs. At 7%, the impact on retailer EBIT could be a hit of 5%-10%.

As shown in the chart below, generally, wage rate decisions have been about one percentage point higher than prevailing inflation. The trimmed mean inflation is currently at 6.6% which may influence the FWC’s thinking. At the same time, most economist’s predictions for inflation are a moderation towards 3%-4% by June 2024.

Chart: General Retail Award wage rate growth compared with CPI since FY14

Source: Industry submissions, FWC, MST Marquee

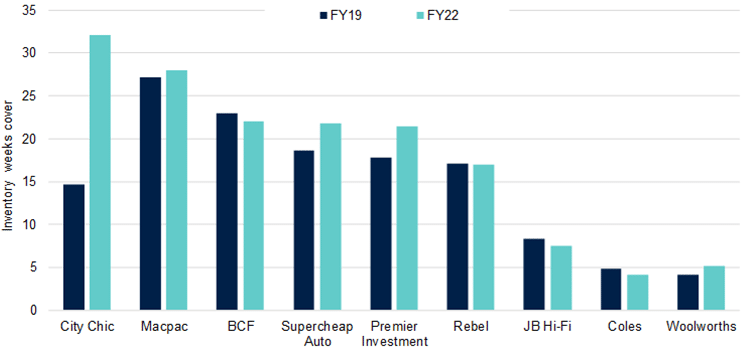

Excess inventory likely to be cleared in 2024

A retailer with excess inventory can quickly sink into financial losses, but the impact usually lasts no more than 12 months. While some Australian retailers have excess inventory, the problems are being cleared quickly and inventory positions are likely to be more balanced in 2024.

In the chart below, we look at the movement in inventory weeks cover for retailers for FY19 and FY22. Any movement above long-term averages or typical category benchmarks signals risks to future gross profit margins. This chart shows a few brands have seen a notable increase in inventory weeks over the last three years. The most extreme is City Chic, which has resulted in a significant drop in gross profit margins. The next two largest increases are for Supercheap Auto and Premier Investments albeit the obsolescence risk is lower for Supercheap Auto reducing the risk of gross margin decline.

Chart: Retail inventory weeks cover (FY19 and FY22)

Source: Company reports, MST Marquee

Craig Woolford, lead analyst at MST Marquee, is known to many of us in the retail sector, with more than 20 years’ experience analysing the retail, food and beverage industries. After gaining an exceptional level of interest in his reports and data-driven insights, Craig established the Retail Mosaic to better inform retailers. The Retail Mosaic website has more than 200 reports (and growing) written by Craig and his team about the sector’s outlook.