Fumbling for the right change in your wallet used to be painful. For years it had the potential to be a major source of frustration at supermarket checkouts, coffee shop counters and train stations all over Australia.

Thanks to technology, these moments have become less common – with the rise of electronic payment methods, and our trusty cards and phones always by our side. Who would’ve ever thought that we’d be able to pay for things with just a swipe of our phone? As a nation, we’re no longer as reliant on cash to get through the day.

Plenty has been said about a cashless future. Most conversations question the legitimacy of this move – what will be the deadline for phasing out cash and what does this mean for those who prefer to use bank notes? And yet for many consumers, this cashless society is already here.

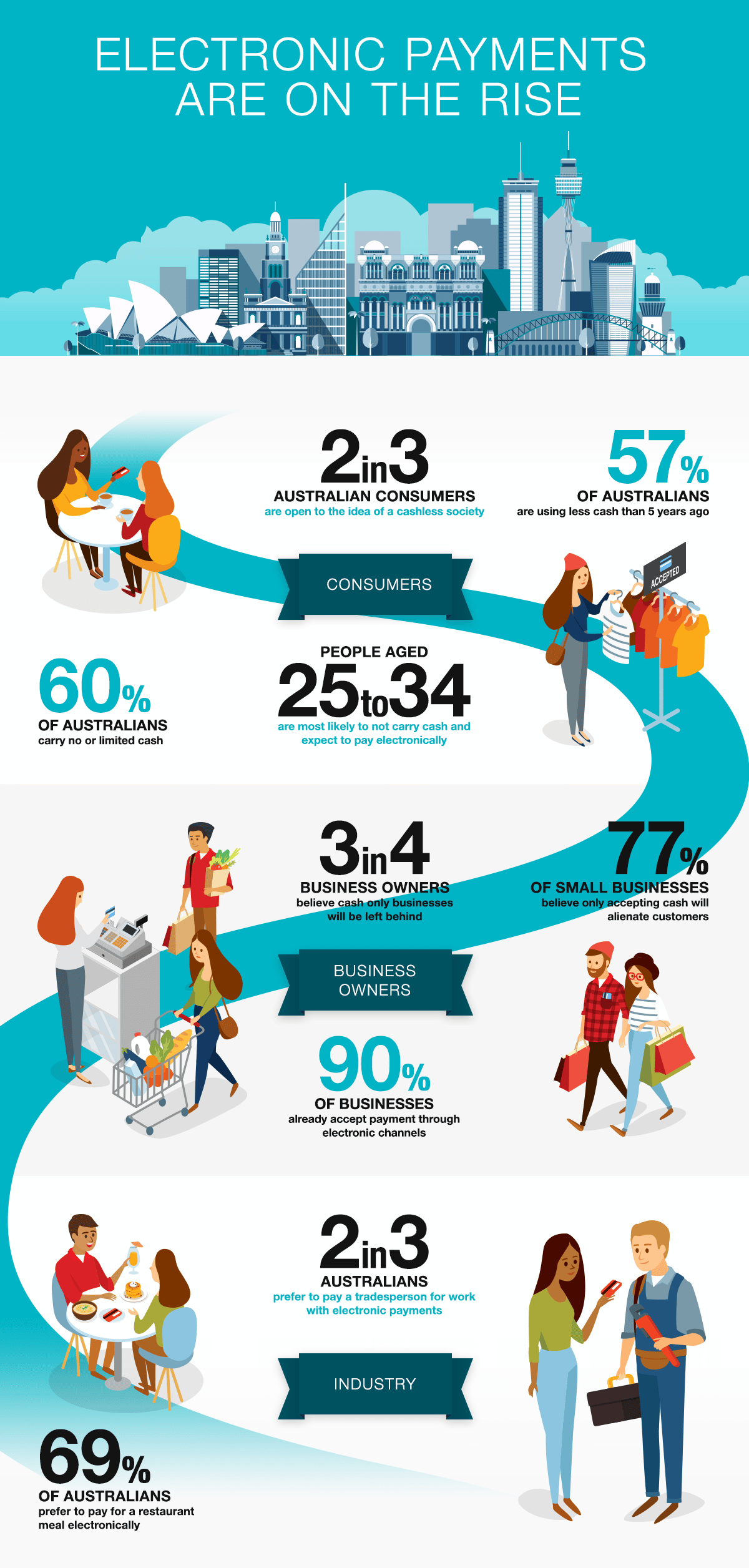

Australian Tax Office research shows more than 75% of all consumer transactions are now electronic. On average, we’re carrying less than $50 at any time. We prefer to use our cards for any purchase over $10. Thanks to initiatives such as the New Payments Platform (NPP) and PayID, which make it easier to transfer money in real time, this trend is likely to only continue.

It used to be a status symbol if you could walk into a dealership and pay cash for a new car. Today, most Australians aren’t even prepared to count out spare change for their morning coffees. They prefer to pay electronically, even for traditional cash transactions such as buying the groceries (75%) or paying a tradesperson (66%).

The cultural shift towards cashless payments is being driven by consumers. They live in a digital world where e-payments are quick, convenient and secure. They don’t want to carry large sums of cash or go digging around for paper receipts when things go wrong.

The research found 90% of businesses already use electronic payments, with 74% saying small businesses that only accept cash will alienate some customers. It also found that generally, the younger you are, the less likely you are to carry cash. Millennials said they hardly carry any cash at all, and expect to use electronic payments for all transactions.

For retailers, it’s about being prepared for this increasingly cashless society – or risk turning customers away.

There are lots of advantages when it comes to using electronic record keeping and payment systems, and they can help you adapt to an increasingly cashless society. By investing in an electronic payment facility, you’ll be able to make it quicker and easier for your business and your customers.

You can find out more about electronic payment systems at ato.gov.au/electronicpayments

For more information on tools and services to support your small business, visit ato.gov.au/SBsupport