Retail businesses face a slow grind in 2024 and we expect below trend sales growth. Moreover, retailers will face continued cost growth pressure and the challenge for most retailers will be whether they can drive sales growth to match cost growth.

Subscribers to our Retail Mosaic website can access research about the retail sales outlook. We also have reports on industry sales trends, gross margin impacts and cost structures, so that businesses can better prepare for the year ahead.

A tale of two halves

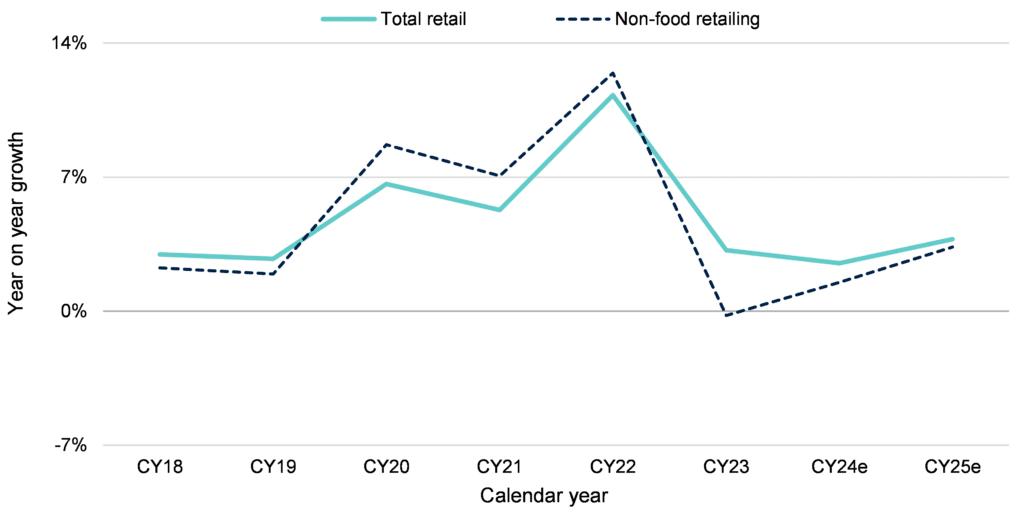

In the chart below, we present our sales growth expectations for calendar year 2024 and 2025. During the first half to June 2024, we expect growth to be slow. Some benefit will flow to retail sales in the second half of the year as stage 3 income tax cuts add some welcome relief and we cycle the impact of interest rate increases. A swing factor for consumer spending will be whether households lift their savings rate after dropping it to near all-time lows in the past year.

Our retail outlook by category is:

- Food & liquor retailing: We see at-home food retailing rising in calendar 2024 but at a slowing pace. This reflects lower price inflation in food categories. We expect supermarkets to be slightly stronger than the broader industry growth, with the majority of the sales growth still driven by population and price inflation.

- Household goods: We forecast household goods to return to growth in calendar 2024, which is a turnaround from the -3.6% in calendar 2023. This rate of growth will be largely driven by population growth with prices likely to decline. Household goods sales should also benefit from an improvement in house prices and housing churn in calendar 2024. We expect a more discernible turnaround in furniture and hardware. Electronics may suffer from limited new product innovation and deflation.

- Department stores and fashion: We estimate fashion categories like apparel, footwear and department stores growth to be flat in calendar 2024, which compares with low single digit growth in 2023. The category is suffering from deflation already and we expect that to continue. Shifts in footwear fashion have helped sales over the past year and may be more challenging in 2024.

- Café, restaurant and takeaway food: We expect the most notable slowdown in sales for cafes, restaurants and takeaway food. The sector did very well in 2023 growing double digits. We forecast sales to grow in 2024 but at a much lower rate, which will include a decline in volumes. The slowdown is likely to be more apparent in cafes/restaurants than in takeaway food where price options are cheaper.

Chart: Australian retail sales forecast by calendar year

Source: ABS, MST Marquee

Outlook

Retail price inflation the battle for financial year 2024

With much of the topline growth over the last two years supported by price inflation, retailers now face the prospect of disinflation and in some cases the return to category deflation. For FY24e we expect volumes to turn positive in contrast to the negative contribution during FY23.

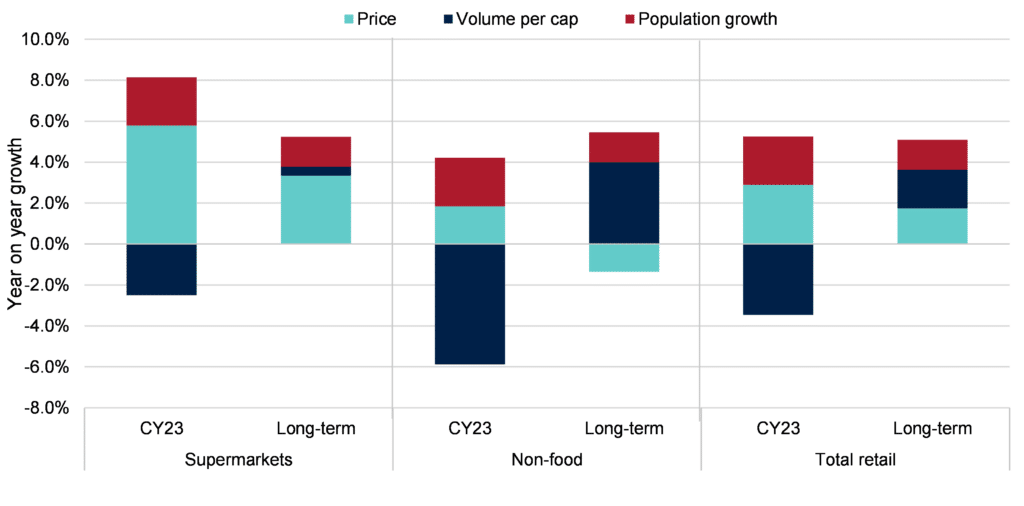

As prices fall, sales growth is negatively impacted. As shown in the chart below, in the long-run, non-food retail sales growth has been driven by positive volumes, population growth but lower prices. Population growth will contribute to growing demand, but volume per capita growth will be needed to mitigate the impact of lower prices for overall growth.

As shown in the chart below, 2023 total retail sales was driven by price and population growth, with volumes on a per capita basis a more than 3% drag on growth. If inflation continues to slow at the pace reported in the recent CPI release for the December 2023 quarter, retailers will battle with anaemic sales.

Chart: Contribution to retail sales growth outlook

Source: ABS, MST Marquee

Cleaner inventory means better gross margins

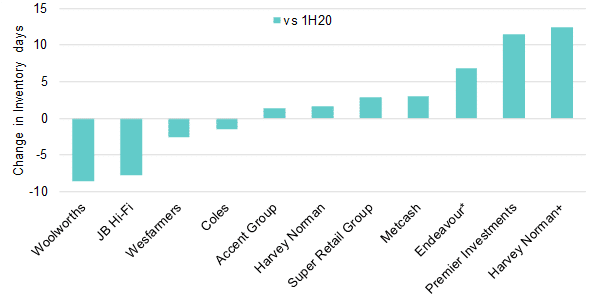

Inventory positions were elevated during COVID-19 as the supply disruptions led to increased inventory holdings for safety. Many retailers are now likely to report lower inventory positions which will translate to stable or improving gross margins. Cleaner inventory means less need to be promotional and equates to higher gross margin outcomes. We forecast more balanced inventory positions in 2024.

In the chart below, we look at the change in inventory days for retailers at December 2019 against our expectation for December 2023 when retailers report their financial results in the next few weeks. For most retailers inventory is back to pre-COVID levels. JB Hi-Fi inventory management is forecast to be in an improved position. While Harvey Norman and Premier Investments have seen days inventory increase compared with pre COVID-19, their inventory position has improved compared with June 2023 (on an inventory days basis) and should normalise further in 2024.

Chart: Retail inventory days (1H24e v 1H20)

Source: Company reports, MST Marquee

A detailed report and chart pack is available to subscribers about the retail outlook for 2024. Visit our website to subscribe Retail Mosaic. Retail Mosaic will offer a 30% discount to ARA members for the first month. Please use the code ARA2024-30 to redeem your discount.

Craig Woolford is known to many of us in the retail sector, with more than 20 years’ experience analysing the retail, food and beverage industries. After gaining an exceptional level of interest in his reports and data-driven insights, Craig established the Retail Mosaic to better inform retailers. The Retail Mosaic website has more than 200 reports (and growing) written by Craig and his team about the sector’s outlook.