Australia’s long-track record of net migration is a source of growth for retailers. Migrants tend to spend more in most areas of retail and are an important labour source to helping the retail sector to thrive. We have published a report on our Retail Mosaic website Retail Mosaic Issue 8 “The role of immigration in retail” analysing the impact migration has across retail categories, geographies and specific retailers. This report is one of more than 300 that Craig Woolford and the team at Retail Mosaic have produced providing insights about the outlook for the retail sector.

Migration impacts on retail spending

On average, population growth contributes 1.5% to retail spending growth. The pandemic led to a negative impact from migration. However, since borders reopened, net migration has turned sharply positive. Australia’s population growth peaked at 2.5% in the September 2023 quarter. Migration peaked at close to 81% of the outsized population growth Australia has experienced over the past year.

Chart: Australian population growth outlook

Source: ABS, MST Marquee

The sources of migration include:

- Student visas: Student visas have historically accounted for 30% of visas issued. Current visa regulations allow foreign students to stay for up to 5 years or in line with course enrolment. Student visa holders are permitted to work for up to 48 hours a fortnight. This would allow a student to work 12 part-time shifts of 4 hours every 14 days.

- Skilled worker visas: There are a range of sub-class visas for workers. This includes business owners and those with assets over A$5 million. There are also employer-sponsored visas as well as visas that require a migrant to settle in a regional area of Australia. Typically, 110,000- 130,000 skilled worker visas are granted each year.

- Working holiday visas: These are provided for 18-30 year olds to stay for up to 12 months and typically can work for one employer for up to six months. A traveller can obtain a second working holiday visa as well. Typically, there are 200,000-240,000 working holiday visas granted each year.

- Visitor visas: The visitor visa is for those travellers who stay in Australia for 3-12 months. Around 4-5 million visitor visas are typically granted. There was a higher number than usual at the end of June 2023, which may reflect timing of those visas as global travel continued to recover.

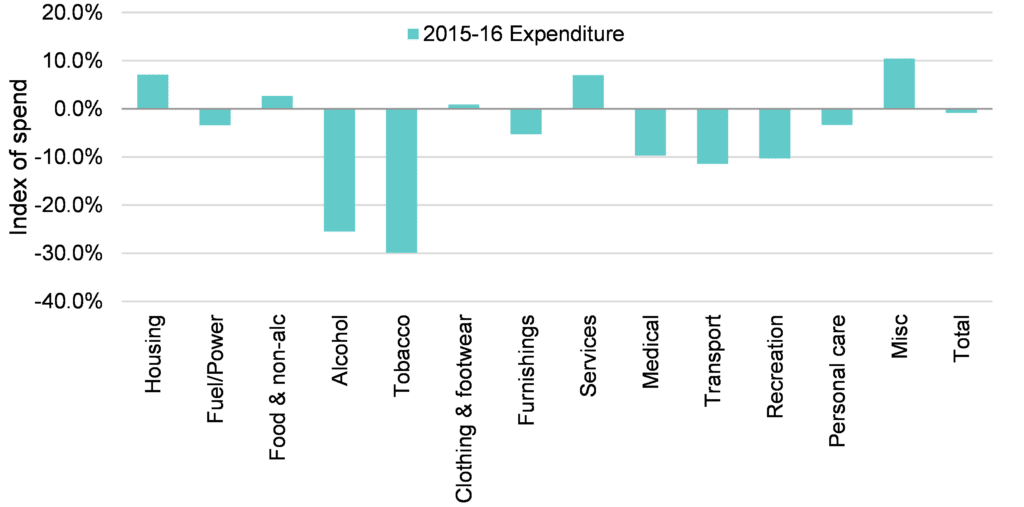

The chart below shows that migrant spending over indexes in housing because migrants are typically working families or students. There is a large deviation in lower spend on alcohol and tobacco where migrants spend close to 25-30% less than non-migrant households. Food and clothing categories are beneficiaries of the growth from migration.

Chart: Migrant category spend indexed to non-migrant spend

Source: ABS, MST Marquee

Chinese net migration is starting to rise again, ranking slightly behind India on numbers of migrants to Australia. Historically, Chinese net migration has also led to a rise in sales in certain luxury and food categories by Chinese students and other migrants. The Daigous are starting to return to Australia as Chinese migration recovers. However, the market is still smaller for two reasons. Firstly inbound tourist arrivals from China to Australia are still 38% lower at the end of 2Q24 vs 2Q19. Secondly, there has been a structural shift towards eCommerce platforms and direct sales in China away from the Daigou channel by some brands and retailers.

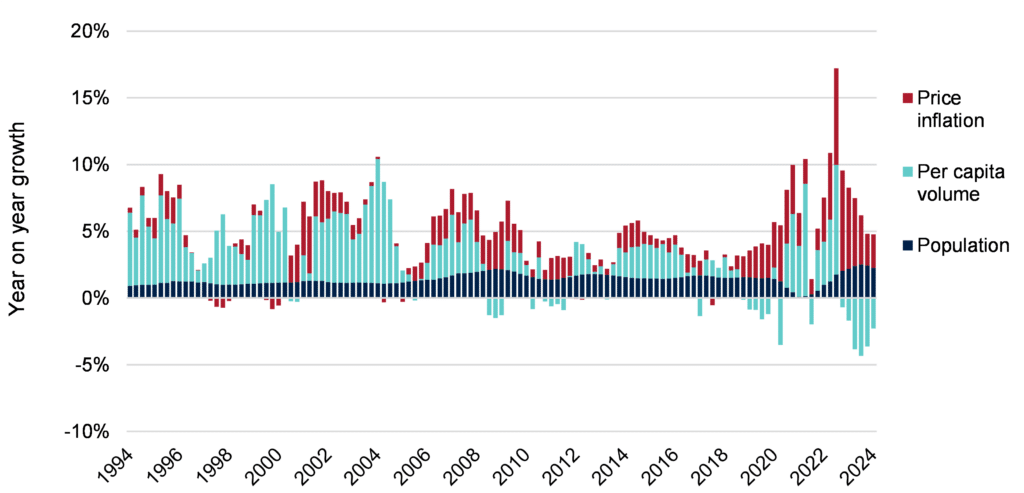

The inference for broader retail volumes given strong population growth

Australian retail sales trends of 1%-2% overall are incredibly weak once the impact of population growth and price inflation are taken into consideration. For the March 2024 quarter, retail per capita volumes fell by 2.3%. Per capita volumes have been in decline since March quarter 2023 and highlight the “retail recession” that has been underway for 12 months.

The good news is that elevated population growth is a partial offset and will recede gradually over the next two years. Moreover, as we move to fiscal 2025, retail volumes should stabilise on a per capita basis. The only concern for us is a drop in retail price inflation. While good for the consumer, if we see price deflation then retail sales growth could remain very weak in many categories. We have seen deflation in key retail categories in recent months.

Chart: Contributions to retail sales growth over the past thirty years

Source: ABS, MST Marquee

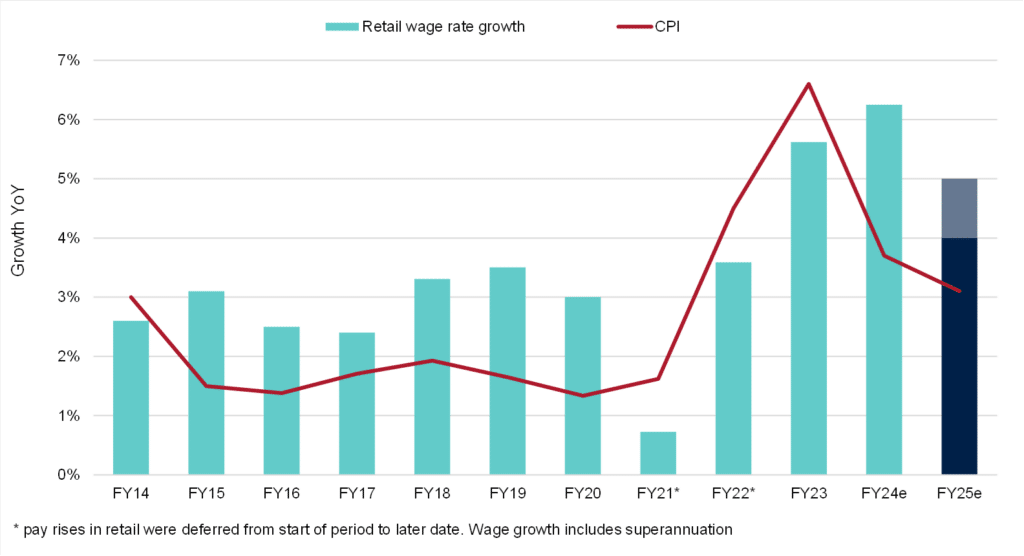

Can migration ease wage inflation?

Australian wage rate growth has been elevated over the past year. The extreme shortages of labour have eased as net migration lifted. However, it remains a tight market. Retail wage rates are likely to remain elevated in fiscal 2025 in our view.

Australian inflation, while slowing, has remained above forecasts. Against the backdrop of inflation falling at a slower rate than forecast, retailers face the headwind of higher for longer interest rates and higher wage awards. The Fair Work Commission incorporates the inflation backdrop into its wage award decision and has historically kept wages marginally higher than the trimmed mean CPI, which came in at 3.5% in the March 2024 quarter. With inflation falling at a slower pace, a minimum wage award increase of 4%-5% is our prediction for fiscal 2025 (inclusive of the 0.5% employer superannuation increase).

Chart: Australian wage rates vs inflation

Source: ABS, Fair Work Commission (FWC), MST Marquee

If you would like a copy of the report Retail Mosaic Issue 8 “The role of immigration in retail”, written by the team, please email enquiries@retailmosaic.com.au

Craig Woolford is known to many of us in the retail sector, with more than 20 years’ experience analysing the retail, food and beverage industries. After gaining an exceptional level of interest in his reports and data-driven insights, Craig established the Retail Mosaic to better inform retailers. The Retail Mosaic website has more than 200 reports (and growing) written by Craig and his team about the sector’s outlook.