What is the outlook for retail rents? Store rent costs can have a significant bearing on profitability for a retailer. The supply of new retail floor space is likely to be low in the near future with elevated building costs and higher interest rates limiting new shopping centre developments. The demand for retail is likely to grow and combined with population growth is supportive of the growth outlook for retail. We expect this mismatch between supply and demand to put upward pressure on rents, particularly rents in high productivity shopping malls.

We have published a report on our Retail Mosaic website Price Watch Issue 8 “The price of rents” providing forecasts for the rent cost outlook. This report is one of more than 300 that Craig Woolford and the team at Retail Mosaic have produced providing insights about the outlook for the retail sector.

Demand and supply imbalance to impact retail profitability

We estimate that there was 2.20 square metres (sqm) of retail floor space per capita in Australia as at June 2023. This has fallen from 2.27 sqm five years ago. The pandemic played a part in delaying new builds, but cost has been a factor too.

Generally, total floor space rose with population growth which we saw occurring between 2013 and 2018. In the period between 2018 and 2023 the total growth in floor space did not keep pace with population growth, leading to the decline in per capita space of 2.20 sqm. By FY28e our expectation is for per capita floor space to fall to 2.12 sqm.

Chart: Estimated space per capita

Source: ABS, Company reports, MST Marquee

Factors contributing to lower space additions:

- Higher building costs: Building costs have risen 25% between 2019 and 2024 according to the producer price index (PPI) published by the Australian Bureau of Statistics. Historically, the annual rate was 1.1% in the period between 2013 and 2018. The inflationary pressure is easing but costs remain elevated compared with historic levels.

- Elevated cost of capital: The rate hiking cycle saw the Australian 10-year bond yield rise above 6% during FY23. This higher cost of capital has lifted the hurdle to fund the construction of new shopping centres.

Using data collated by Jones Lang Lasalle (JLL) on the pipeline of development activity we can see that the supply growth of new retail floor space in 2022 and 2023 was 50-60% lower than the average from 2013-2019.

With a modest forecast for the increase in retail floor space and population growth reverting to historic averages, retail space per capita is set to drop in the future. We expect to see an intensifying competition for quality sites and where possible, retailers internalising property development.

Retail demand will continue to rise drive by population growth

We see the fundamental drivers of retail floor space demand as

- population and demographics

- product innovation and preference

- price-volume trade off, and

- online vs in-store demand.

Population growth during 2023 and 2024 was outsized and was a correction on the pandemic impacted period of 2020-2022. Australia, like other developed countries, is facing a gradual ageing population which is a slight negative for retail demand. Those aged 55 or older tend to spend less money in retail than those aged 25-54. The trend is gradual and only a minor drag over the next 5-10 years. Australia remains an attractive migration destination for many and will remain a preferred destination in the future but at a more normalised rate. Over the long-term population growth has averaged 1.4% which is slightly lower than our expectations for growth out to FY28e.

Chart: Australian population growth

Source: ABS, MST Marquee

Another aspect of demand to consider is how retail volumes on a per capita basis have changed historically. Using the 10 years to 2019, with 2019 our reference year to remove the pandemic impact, retail volumes grew 0.8% per capita. The growth is higher when looking out on a longer time horizon which is explained by consumption habits shifting to more frequent purchases driven by innovation in electronics and also the rise of fast-fashion and cheaper imports which have all contributed to stimulated demand.

Does online help solve the space issue?

Online is understandably seen as a leakage to traditional bricks and mortar retail. We estimate online sales accounted for 14% of all retail sales in FY24. Moreover, we estimate existing multi-channel retailers account for 75% of online sales, while pure play online retailers like Amazon, eBay, Kogan and Adore Beauty account for 25%.

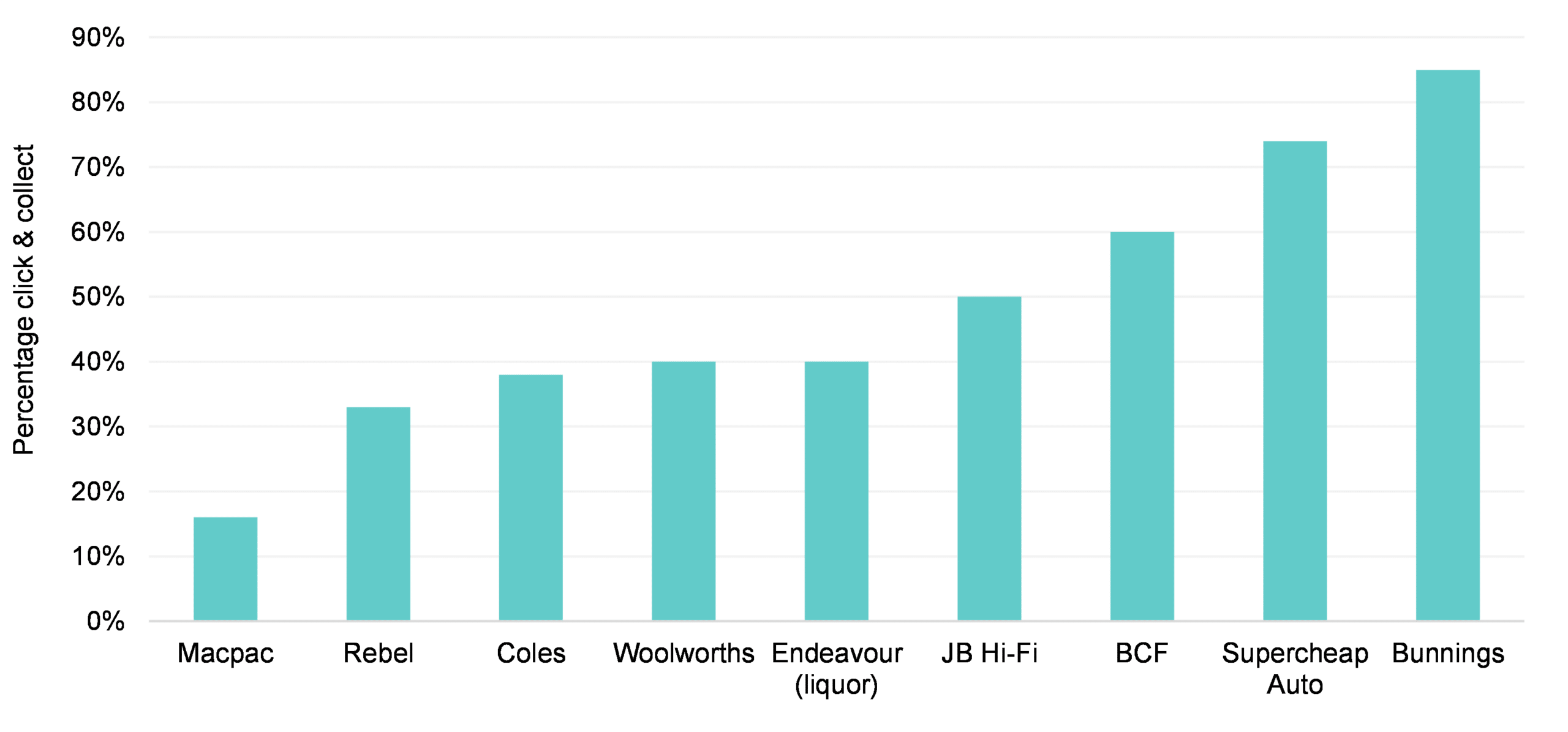

Many multi-channel retailers use their store network to fulfill orders with click & collect a popular choice for many shoppers. The share of click & collect of online sales for a range of large ASX-listed retailers is shown in the chart below. Online demand growth will be a drag on retail floor space performance, but at a smaller level than the total growth of online. We expect the demand growth from online pure play to be about 0.5% per annum over the next five years and a detraction from the retail space needed in shopping centres.

Chart: Share of online that is click & collect

Source: Company reports, MST Marquee

If you would like to learn more about the rental cost outlook, request a copy of the Price Watch Issue 8 “The price of rents” report from the Retail Mosaic team by emailing enquiries@retailmosaic.com.au

Craig Woolford is known to many of us in the retail sector, with more than 23 years’ experience analysing the retail, food and beverage industries. After gaining an exceptional level of interest in his reports and data-driven insights, Craig established the Retail Mosaic to better inform retailers. The Retail Mosaic website has more than 300 reports (and growing) written by Craig and his team about the sector’s outlook.

See Craig Woolford in person at the ARA Peak Season Insights Breakfast at the Fullerton Hotel Sydney on 16 October 2024. Register here.