Retail

Reputation

From a reputation perspective, what does the retail sector need to focus on in 2023?

The Reputation of Companies in Australia

Oliver Freedman

Managing Director

All companies, including those in the retail space, need to focus on how they respond to these concerns, both with product and service offerings, but also in ways that help those most affected in the broader community.

The year of 2022 included a vast array of events that have provided significant challenges for many within the Australian as well as global community. 2022 started with an exponential increase in COVID-19 cases, followed by some of the worst flooding experienced in NSW which was repeated many times during the year and also experienced in Victoria and Queensland. All of this occurred while the cost of living increased at a faster rate than most had experienced in their lifetime, with particular pressure on basic groceries followed in the second half of the year by month after month of interest rises and rapidly increasing energy prices.

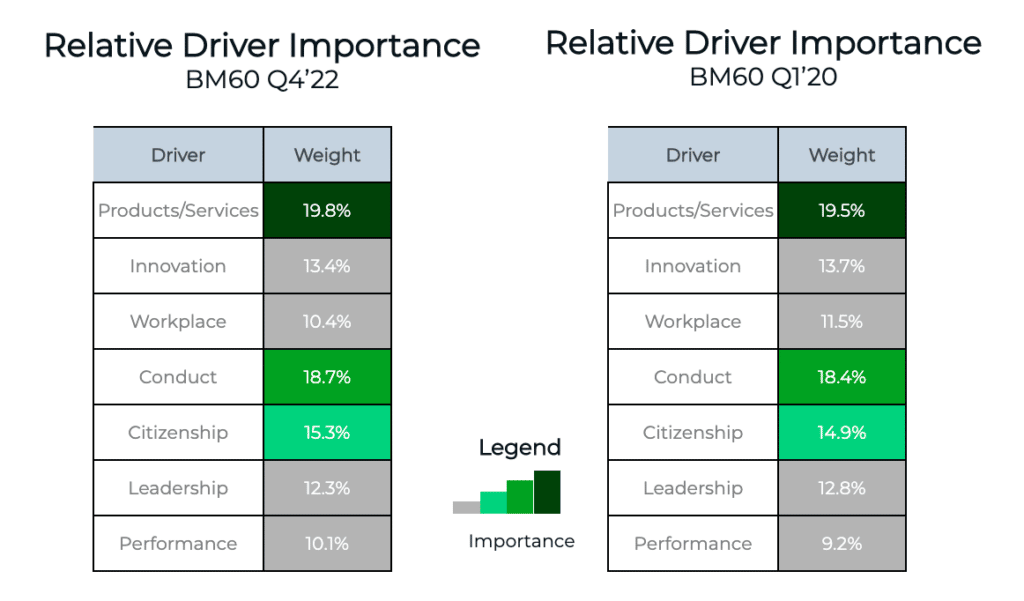

However, despite all of these events, the key drivers of reputation have remained relatively stable. The public continue to reward companies which show strong levels of capability in their delivery of products and services, adapting to change and financial sustainability as well as character in their behaviour towards the community and employees.

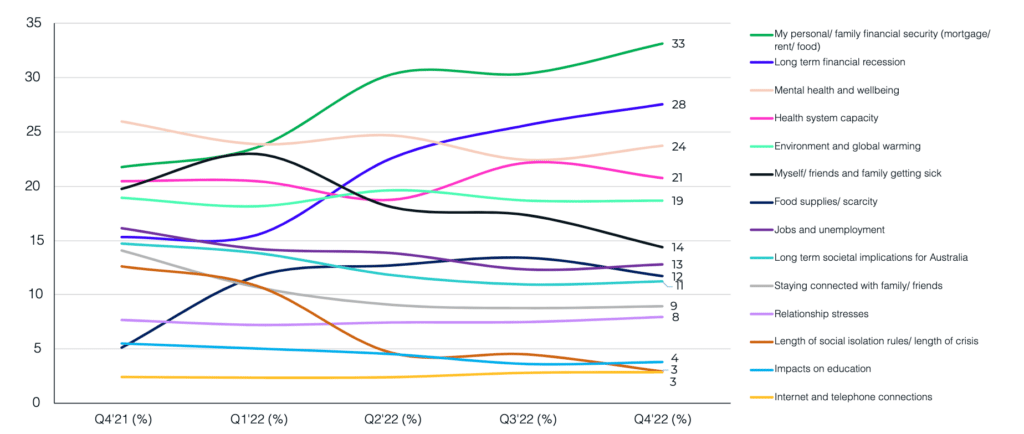

One of the main concerns for the public that has continued to grow over the past twelve months has been ‘final security’ and an ‘economic recession’. At the end of 2021, the public named ‘mental health’ as its largest concern (out of RepTrak’s list of 14 options) with ‘financial security’ in second and ‘long term financial recession’ in seventh spot behind issues such as ‘health system capacity’ and ‘environment/global warming’. By the end of 2022, ‘financial security’ was clearly number one, with ‘long term recession’ in the second spot.

At the end of 2021, the public named

'mental health'

as its largest concern, with ‘financial security’ in second and ‘long term financial recession’ in seventh spot.

But by the end of 2022

'financial security'

was clearly number one, with ‘long term recession’ in second spot.

Therefore, all companies, including those in the retail space, need to focus on how they respond to these concerns, both with product and service offerings, but also in ways that help those most affected in the broader community. The positive news is that despite these challenging times, the public continues to show similar levels of trust, admiration and respect towards Australia’s largest companies. This suggests that the actions taken to mitigate these challenges have been well received. For example, even with the sharpest rise in interest rates in living memory, levels of trust, admiration and respect for the four major banks remained relatively stable.

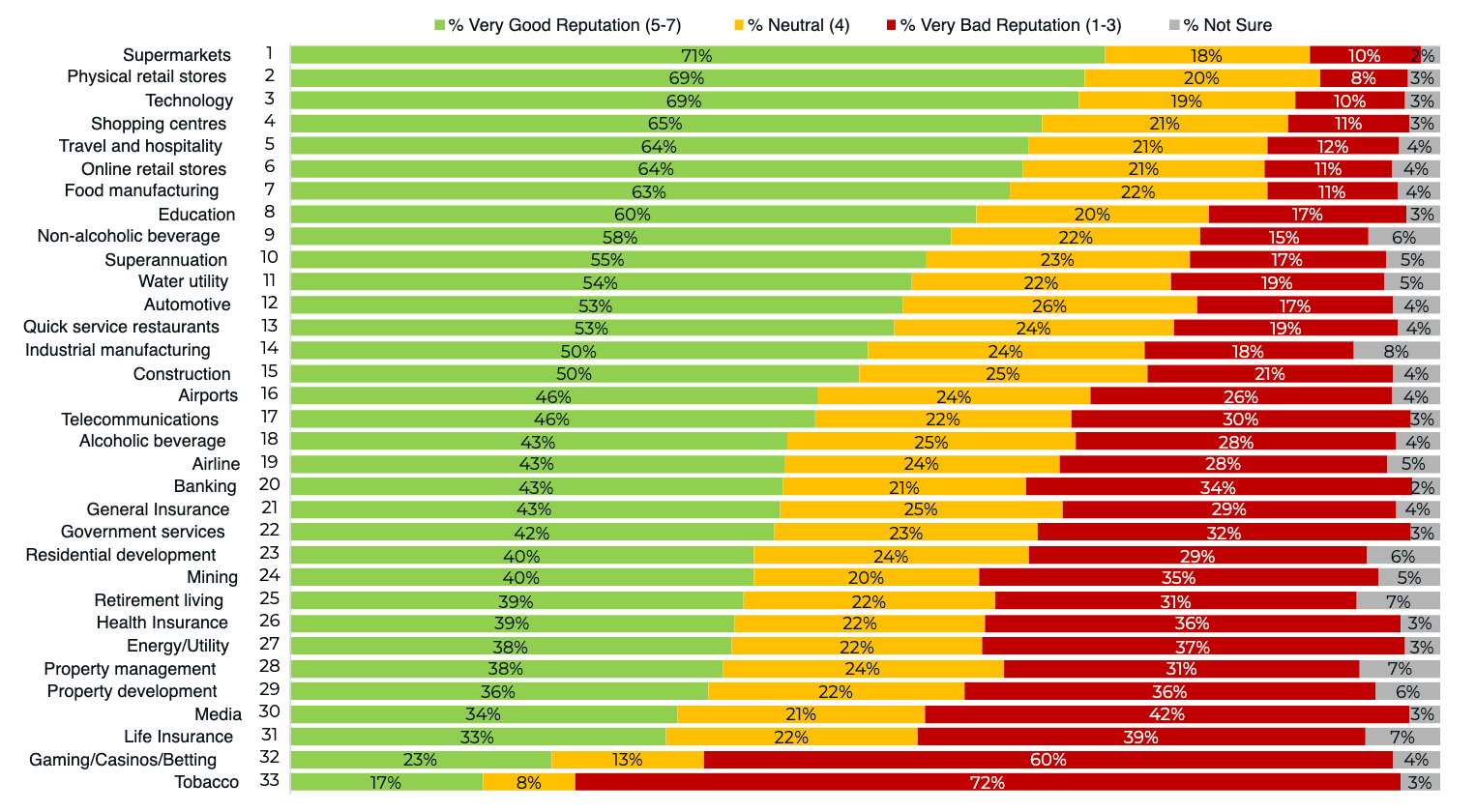

The public’s view of the retail sector has remained strong and stable. RepTrak’s industry reputation tracking has ‘Physical Retail Stores’ ranked second of the 33 industries tracked, with over two thirds of the public stating the industry has a strong reputation. ‘Shopping Centres’ and ‘Online Retail Stores’ also rank in the top six with similar levels of positivity.

From a reputation perspective, what does the retail sector need to focus on in 2023?

RepTrak has identified three key challenges for the retail sector in 2023

Reputation risk surrounding staff reductions.

One of the challenges for all sectors, but especially the retail sector due to its large employee base, is the reputational risk surrounding any lay-offs or redundancies. Despite the concern over cost of living and recession, there appears little worry over unemployment levels. In addition, over the past two years, the community has generally responded negatively when companies have made decisions to reduce staff levels, with perceptions decreasing on the character-based drivers of not just workplace but also conduct and citizenship. Redundancies tend to negatively impact perceptions that companies are doing the right thing by the community.

Data security – Lessons from Optus and Medibank.

The second major challenge is data privacy. The data hacks experienced by both Medibank and Optus in the last three months of 2022 led to extremely large declines in the levels of trust, admiration and respect felt for the companies and we believe this will take significant time to be restored. Optus and Medibank took quite different strategies in handling the breaches, yet both significantly decreased, falling into the ‘weak’ range after many years of having reputations in the ‘average’ to ‘strong’ range.

While the retail sector should have fewer critical documents (e.g. driver licences, Medicare cards, passports), the sector holds an incredible amount of personal information about customers, particularly through loyalty programs. At this time, and given the events of last year, it does appear that any privacy breaches will lead to a reduction in reputation. And while management of the crisis could help to mitigate some of the decline, it is clear that investment in avoiding the occurrence must be the priority.

ESG – Making the actions relatable to the public.

RepTrak has now been tracking perceptions of companies using its ‘new’ ESG model for two years. Surprisingly, it is those companies in industries with the greatest environmental challenges that seem to be regarded most positively in this area. For example, last quarter RepTrak measured the reputations of 187 companies of which 40 were from the retail sector. In comparing the overall reputation score to the ‘environment’ component from our ESG metric, the average gap for retailers was -6.5, with not a single company recording a stronger ‘environment’ result than overall reputation. In contrast, the average for the 187 companies was -3.6. For the energy/utility companies, it was -0.2.

That is, the public views retailers lower around environmental actions compared to its overall level of trust, admiration and respect. And importantly, the public is perceiving the energy/utility companies as almost identical to the retail industry on the environment component despite the energy sector’s larger carbon footprint.

We believe the challenge is to enable the public to understand why actions are needed by retailers in this space and then to understand what those actions are and how they are being actioned. If this can be achieved, then there is the opportunity to further boost the reputation of the industry.

About the author

Oliver Freedman

Managing Director

Oliver is a passionate reputation expert. RepTrak, a market leading global consumer data and insights business, which has tracked the reputation of retail brands for over two decades, was established by Freedman in Australia in 2017. He has used the business to create a conversational bridge between Australian consumers and the businesses that serve them. Prior to that, he was Managing Director of AMR, one of Australia’s leading market research companies and also worked for Harris Interactive in the US.

Expert contributors