Consumer

Trends

As we head into 2023, it’s important for merchants to be familiar with the retail habits of the next generation of shoppers. While Gen Z is still young, they have already experienced two significant global financial events (the GFC and the pandemic). They are accustomed to change and are resilient optimists.

The retail sector is increasingly investing in creating innovative, smart retail environments and experiences using a broad array of smart retail technologies (SRTs).

Understanding the Next Gen of Shoppers

ARA Strategic Partner

Over 50% of Gen Z start their buying journey on social media, overtaking any other channel. Gen Z don’t just love social media - it’s a crucial part of their lives.

Over 50% of Gen Z start their buying journey on social media, overtaking any other channel. Gen Z don’t just love social media – it’s a crucial part of their lives. As we head into 2023, it’s important for merchants to be familiar with the retail habits of the next generation of shoppers. While Gen Z is still young, they have already experienced two significant global financial events (the GFC and the pandemic). They are accustomed to change and are resilient optimists.

The recent Afterpay Beyond the crocs & TikToks: How Gen Z are shopping report found that the size of the retail market for Millennials and Gen Zs will be substantially larger than that of their predecessors, with their discretionary share of retail spend forecasted to increase to 40% by 2030. Millennials and Gen Z are a growing economic force – their approach to shopping, managing their finances and their values continues to set them apart.

According to Square’s recent Future of Retail Report, these consumers are sophisticated, digitally savvy and concerned with conscious consumption, with almost 90% of shoppers agreeing that business values matter. Hence, strategising ways to capture this demographic is essential for retailers to thrive in the long term.

The Four Key Gen Z Trends

1

SOCIAL COMMERCE

Over 50% of Gen Z start their buying journey on social media, overtaking any other channel.

As the lines of entertainment, commerce and social media blend into one, being able to shop directly from one platform is key. Gen Z don’t just love social media – it’s a crucial part of their lives. It’s a means of communication and constant networking; a way to socialize and purposefully build identity; a way to follow and influence trends; learn new skills; and maybe most importantly, it’s a source of inspiration, especially for shopping.

Social media has significant conversion power, with nearly half of young consumers willing to purchase a product based on an influencer’s recommendation. Factor in some platforms’ direct purchasing offerings and it’s clear that social media has become a powerhouse across the entire consumer shopping journey.

Despite all this, young consumers know that a curated social media presence is not a true reflection of real life – they are sceptical about whether influencers use the products they advertise and are concerned about how social media companies are monetising their data. It may be time for retailers to evaluate how they are using social media to drive new customers in store and online and ensure they are emphasising authenticity.

2

GENERATION GREEN

This gen cares deeply about a company’s ethical values, with over half buying sustainable products where possible.

Gen Z are leading the charge in proactively seeking out sustainable brands. This gen cares deeply about a company’s ethical values, with over half buying sustainable products where possible. Brands with poor reputations around sustainability and ethics are seeing abandonment by Gen Z. Nevertheless, we have learnt that Gen Z believe in second chances, and cancel culture isn’t set in stone.

Over half of Gen Z are willing to forgive when brands change their approach and buy into sustainable and ethical practices. Transparency around a brand’s eco footprint is fundamental in sustaining trust.

3

MAKE IT WORTH MY TIME

Convenience, data protection, inclusive advertisement and the joy of supporting small businesses all play a role in securing Gen Z’s loyalty.

Gen Z are savvy, socially minded, financially switched on and forward thinking. They think carefully about the long term impact of their purchases on others and the environment, to the point of abandoning a purchase if it just doesn’t feel right. Securing Gen Z loyalty is two-fold: ease and convenience around purchase is fundamental, while corporate social responsibility commitments of a brand are a must for retaining trust.

Reasons not to shop with a retailer include hefty delivery fees, a lack of reviews, poor reputation around ethics and sustainability and a preferred payment method not being available. Younger consumers are also focused on ethical issues such as inclusive and transparent advertising, eco friendliness and corporate social responsibility, with greater numbers of Gen Zs citing these loyalty factors as reasons to keep coming back to a retailer.

4

OMNI CHANNEL OR NOTHING

Reviews, price comparisons and online algorithms to personalise the experience also have gained Gen Z’s favour.

It’s also not surprising that a generation who grew up on social media value having a world of shopping at their fingertips. Gen Zs want more ways to shop 24/7 – no matter what time it is or where they are. Ease, accessibility and comparison are the key themes of why over half of this demographic prefer online to in-store.

Reviews, price comparisons and online algorithms to personalise the experience also have gained Gen Z’s favour. A streamlined online experience is important, as more than half of Gen Z consumers believe online algorithms help them see more of what matters.

Nevertheless, in-store still has its ‘it’ factor. Shoppers still recognise the importance of being able to try before they buy – with delivery delays and costs turning even more young consumers into omnichannel shoppers. With that said, they have high expectations for their in-store experiences – the rise of physi-digital shopping is a trend that’s here to stay.

Shoppers want to compare by feeling, seeing and trying items; want to access their items immediately; and want to take delivery easily and without paying a high cost. As a result, omnichannel selling is fundamental for retailers to retain loyalty and remain competitive.

Purchasing products through digital avenues is forecasted only to increase and alternate shopping methods are the new reality. The Metaverse promises an integrated world that offers it all – from shopping to socialising – entirely from the comfort of your headset. However, the Metaverse is not without its controversy. Branded as unrealistic and unnecessary, it certainly has its detractors. However, these detractors don’t include Gen Z.

Over half of the Gen Z cohort believe the Metaverse will be an everyday part of life in the next 10 years. This interest further blurs the lines between the real and virtual, with over 70% of Gen Z interested in buying real world items in the Metaverse, and over 60% interested in buying virtual items. Therefore, it is important for retailers to continue exploring new technologies to entice consumers and market product offerings.

Understanding Consumers’ Perceptions

towards Smart Retail Technology

Gary Mortimer

Professor of Marketing and Consumer Behaviour

Our findings identified that customers do have preferences for different types of SRTs across the retail sector, the most popular being ‘smart mirrors’ and ‘scan and go’ transaction technology.

The retail sector is increasingly investing in creating innovative, smart retail environments and experiences using a broad array of smart retail technologies (SRTs). Existing research indicates significant benefits for retailers and customers. However, with innovative technology developing rapidly, there is little evidence available to guide retailers on the optimum deployment of these technologies.

Many questions still exist, ranging from customer acceptance of different types of SRTs, to appropriate distance and space between SRTs and customers in physical retail spaces, to how preferences for SRT use may vary among different customers. To address these questions, QUT researchers sought input from over 700 Australian retail customers via an online survey.

Do customers accept SRTs in retail environments?

Our findings identified that customers do have preferences for different types of SRTs across the retail sector, the most popular being ‘smart mirrors’ and ‘scan and go’ transaction technology.

- Smart mirrors (e.g., mirrors that allow you to try on clothing virtually)

- ‘Scan and go’ (e.g., being automatically charged after leaving a store, without needing to use the checkout)

- Interactive digital screens (e.g., screens throughout the store and/or at the shelves to provide information)

- Augmented reality/virtual reality (e.g., virtually trying out products)

- Service robots (e.g., robots that assist human customers and/or employees in store)

- Telepresence robots (e.g., remote-controlled robots that allow you to ‘walk around’ the store and shop from home)

- Drones (e.g., delivering products to your home via drone)

Almost 40% of customers indicated they would prefer SRTs that could perform tasks, such as helping carrying goods to their car or cleaning up spills or trip hazards within a store. Over 36% of customers wanted service robots to bring food or drinks to their table. However, only 10% of customers were interested in SRTs that could aid in re-ordering products. Less than 9% wanted SRTs to provide advice on what to purchase. The defining characteristic of the least-preferred tasks is their level of proactivity; that is, the SRT acting with agency and making decisions for the customer. This indicates customers remain unwilling to delegate their authority to technology.

Overall, customers’ attitudes towards retailers who implement smart technologies were generally neutral. This suggests customers may not comprehend the relative advantage offered by SRTs or how well SRTs can ‘fit’ into customer lives and lifestyles.

What is the preferred distance between human customers and robot service workers in retail environments?

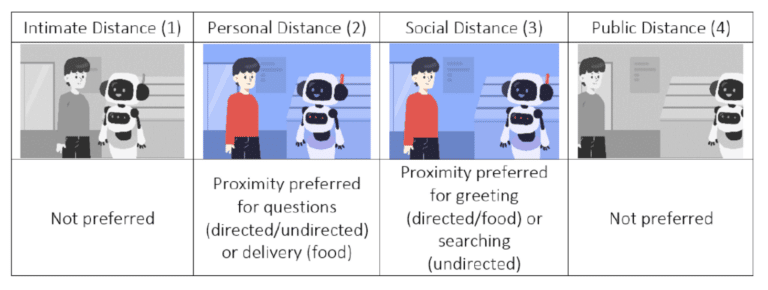

Results indicated SRTs should operate within ‘personal’ or ‘social distance’ zones. On average, customers would prefer to engage with service robots that were at a social distance when shopping or browsing but would prefer a personal distance in food service.

A visual representation of the preferred distance options between customers and SRTs is presented here.

These choices reflect that service robots need to stand at a functional distance (e.g., able to hear/respond to questions, place food on a table) but also be respectful of human relational norms (e.g., standing further away when first ‘meeting’ the human during the greeting stage or when the human wishes to browse the store). The intimate distance zone is too close for comfort and the public zone distance was considered too far away.

Do individual differences influence customer preferences for SRT roles or proximity?

Those with higher incomes have more positive attitudes to SRTs. Customers with a higher preference for ‘personal space’ tended to apply these same preferences to SRTs, preferring to be further away from SRTs. The only exception was for food service. Innovativeness importance will be integral to a positive reception for early SRT adoption. Customers with high ‘innovativeness importance’ reported more positive attitudes and saw greater relative advantage and greater compatibility with SRTs. Those with high innovativeness also had closer proximity preferences. Accordingly, customers who value innovation are likely to respond more positively to SRTs in general and even stand closer to SRTs.

Younger customers preferred ‘instrumental’ assistance (carrying, having food or products delivered) while older customers preferred ‘informational’ assistance. Women were more open than men to have an SRT fill their car with petrol. Women also ranked ‘smart mirrors’ more favourably than men. Men, on the other hand, ranked service robots higher than women did. Married, busy professionals ranked ‘scan and go’ SRTs more highly than other groups. It is suggested customers may have a ‘cluster’ of SRTs they prefer. For instance, those interested in ‘smart mirrors’ were also likely to be interested in AR/VR but not in robots or drones. Those interested in robots were also likely to select ‘telepresence robots’ but less likely to select almost any other technology.

In summary, three key insights or themes emerged:

SRTs need to ‘walk before they can run’

Customers currently exhibit some ambivalence in their attitudes towards retailers deploying SRTs. The data indicated that customers are not interested in ‘technology for technology’s sake’. The data also indicated that customers tend to select SRTs that provide a ‘functional’ benefit. SRTs are unfamiliar technologies for most customers, so for now, the technology may need to focus on more ‘passive’ roles, while customers build their experience and expectations. If SRTs can provide meaningful benefits for customers and ensure that engagement is always a ‘choice’, rather than a ‘forced option’, then initial experiences of SRTs can provide a positive experience and in turn lay the foundation for more proactive engagement in the future.

Technology proximity should be determined by function and social norms

While service robots were the primary focus of the research, lessons for proximity may be drawn for other similar SRTs. Customers indicated a general preference for service robots to operate within personal and social distances, with some variation coming across different types of shopping journeys and different stages within each customer journey. How close an SRT ‘stands’ to a human customer is therefore reliant on functional and pragmatic considerations (e.g., audibility when answering questions, the ability to easily pass items/food to the human) and potentially also on relational norms (e.g., standing further away when greeting a customer as they are not ‘familiar’ yet, or giving a customer more privacy while browsing as opposed to when seeking a particular item). SRTs should therefore have their default distances programmed within the personal/social proximity zones and move closer/further away according to task/functionality while also being programmed to respect relational norms.

SRTs need to cater to different expectations and may need to work in teams

Individual customer differences can influence everything from preferred proximity to SRT acceptance, preferred type of SRT, and even expectations for the types of roles or tasks that SRTs should be performing. It will therefore be imperative to offer flexibility. Flexibility can be offered by providing ‘opt-in’ and ‘opt-out’ situations when in store. Customers indicated a stronger willingness to engage with SRTs when given the choice, rather than having the technology forced upon them.

About the authors

Gary Mortimer

Professor of Marketing and Consumer Behaviour

Prior to joining QUT, Professor Mortimer spent over 25 years working with some of Australia’s largest general merchandise and food retailers. In 2020, he was appointed as the Chair of the Australian Retailers Association (ARA) Consumer Research Advisory Committee and to the Expert Advisory Group for the NSW Department of Planning, Industry and Environment Employment Zones Reform.

ARA Strategic Partner

Afterpay Limited is an Australian financial technology company best known for its buy now, pay later service. It operates in Australia, the United Kingdom, Canada, the United States and New Zealand.

Expert contributors